Member-only story

Score! The new dating app that uses credit scores as a pre-screener

When the heart is looking for both warmth and financial harmony

Just in time for Valentine’s Day, the financial platform Neon Money Club has launched Score, a dating app that integrates the financial health of its members with their desire to go on a date.[1]

With their 90-days limited time release of Score, Neon Money Club has successfully tapped into the hot combinator duo, love and money.

Marrying financial technology with dating technology, Neon Money Club has indeed created a new niche market for anyone looking for a date, but with the caveat that the dating candidate also needs to be financially compatible.

Author’s note: I have no affiliation with either Neon Money Club nor Score.

Love, money, and lasting relationships

In the world of relationships, the conversation about money can often make or break the love nest.

While some couples see their financial road together as the ultimate adventurous journey, others experience it as a grueling exercise in revelations and confessions about spending habits and empty wallets.

Neon Money Club, the creator of Score, promotes a deep awareness of where to spend one’s time, money, and energy, urging their members to not just buy things but invest in experiences and vibes.

Joining Score

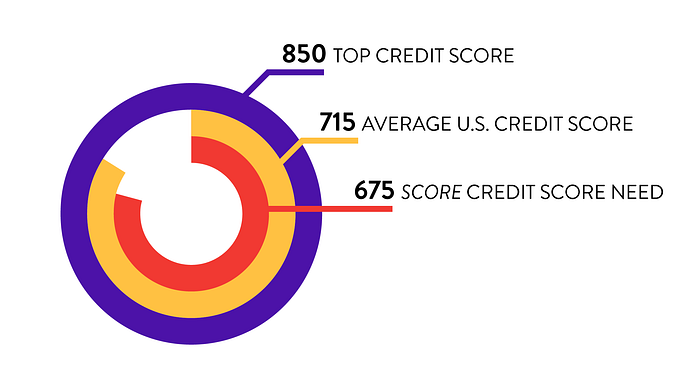

Users seeking to sign up to the Score app are asked to present a credit score of 675 or higher to be accepted. According to Experian, the average U.S. credit score was 715 at the end of Q3 in 2023.[2]

At first glance, a 675 score seems to be an acceptable level that includes of a wide range of date seekers!

However, on deeper analysis, a credit score of 675 is sending Score applicants into the top 20% of all credit score holders. That means that your credit score needs to be in good to excellent standing to be become a Score member.